Accor SA

LONG Accor, France's hotel multinational is the single largest hospitality company in Europe and the sixth-largest worldwide.

Marked business improvement after the Q2 trough

Strong cash and maintained liquidity above €4bn

Digitalization of business and loyalty program: Augmented hospitality

Sanitation moat

Hotel office promising pivot

Well positioned for Asia and MEA future growth

The premise

Accor operates in 110 countries, with more than 5,100 hotels and 300,000 employees, Accor owns and operates brands that cover every segment of hospitality, such as luxury segment (which includes Raffles, Fairmont and Sofitel), premium segment (which includes MGallery, Pullman and Swissôtel), midscale segment (which includes Novotel, Mercure and Adagio) and economy segment (which includes ibis and hotelF1). Accor also owns companies specialized in digital hospitality and event organization, such as onefinestay, D-Edge, ResDiary, John Paul, and Potel & Chabot.

Sequana Tower, Accor's headquarters, Wikipedia

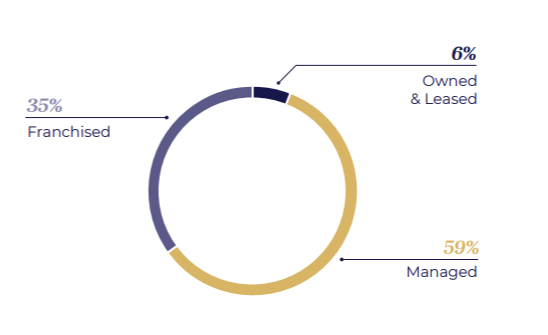

Asset-light

In the mid-90s, Accor shifted its interest towards managing more luxury and premium brands, and moved towards an asset-light model to focus more on brand and product management, and less on property management.

CEO Sebastien Bazin interview right before COVID crisis, talks about strategy

Multi-brand strategy

In 2007, Accor launched the serviced-apartments brand Adagio in a 50/50 venture with Pierre & Vacances, relaunched Pullman as a premium hotel brand, and the Australian All Seasons as a global midscale hotel brand. In 2008, it launched the MGallery collection of upscale "personality" hotels. In 2010, reviews from TripAdvisor were embedded on some of Accor's property websites, a first in the industry.

Integrated hospitality platform

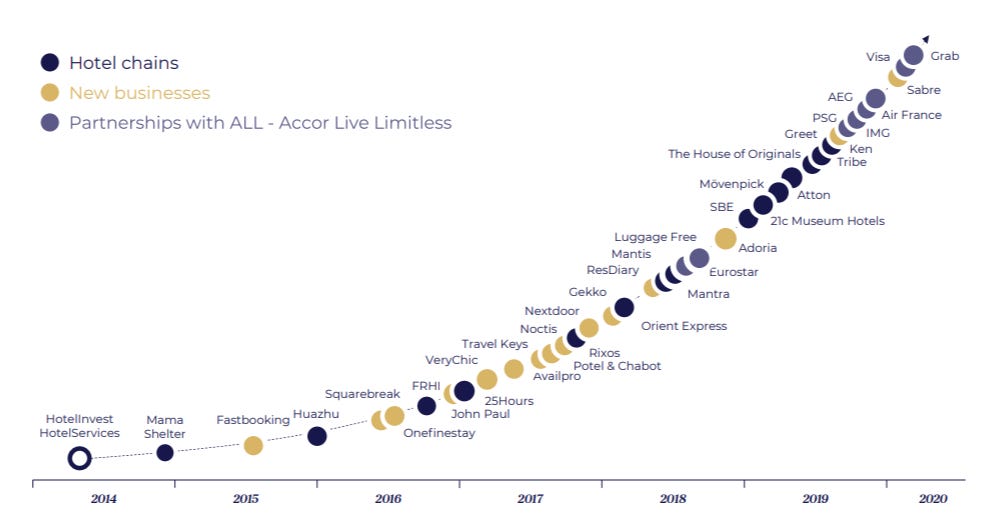

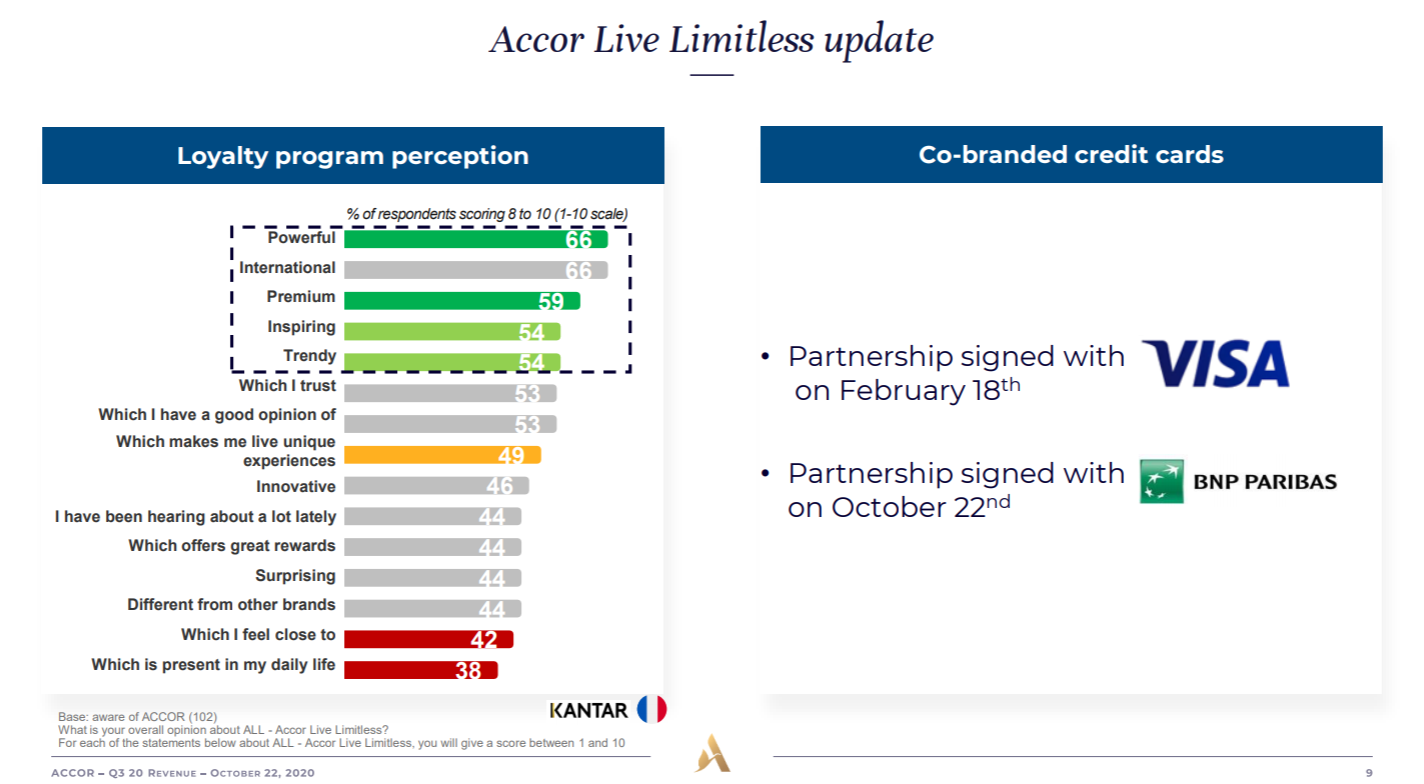

In June 2015, Accor changed its name to AccorHotels and announced the rollout of a new digital strategy to federate its brands. On 3 December 2019, Accor repositioned its brand as ALL - Accor Live Limitless. The update merged AccorHotels and its loyalty offering Le Club into one unified brand, ALL.

In 2020, despite the COVID-19 pandemic, Accor opened 10 new hotels, Accor announced that it recently entered into negotiations with Ennismore, the company behind brands The Huxton, Gleneagles, and WorkingFrom, in order to form a large global marketed-lifestyle operator in the hospitality sector, focusing on a fast-growing segment of the industry. At its inception, the combined entity will comprise 12 brands with 73 hotels in operation worldwide and will take the name Ennismore. Closing is expected to occur in the first semester of 2021.

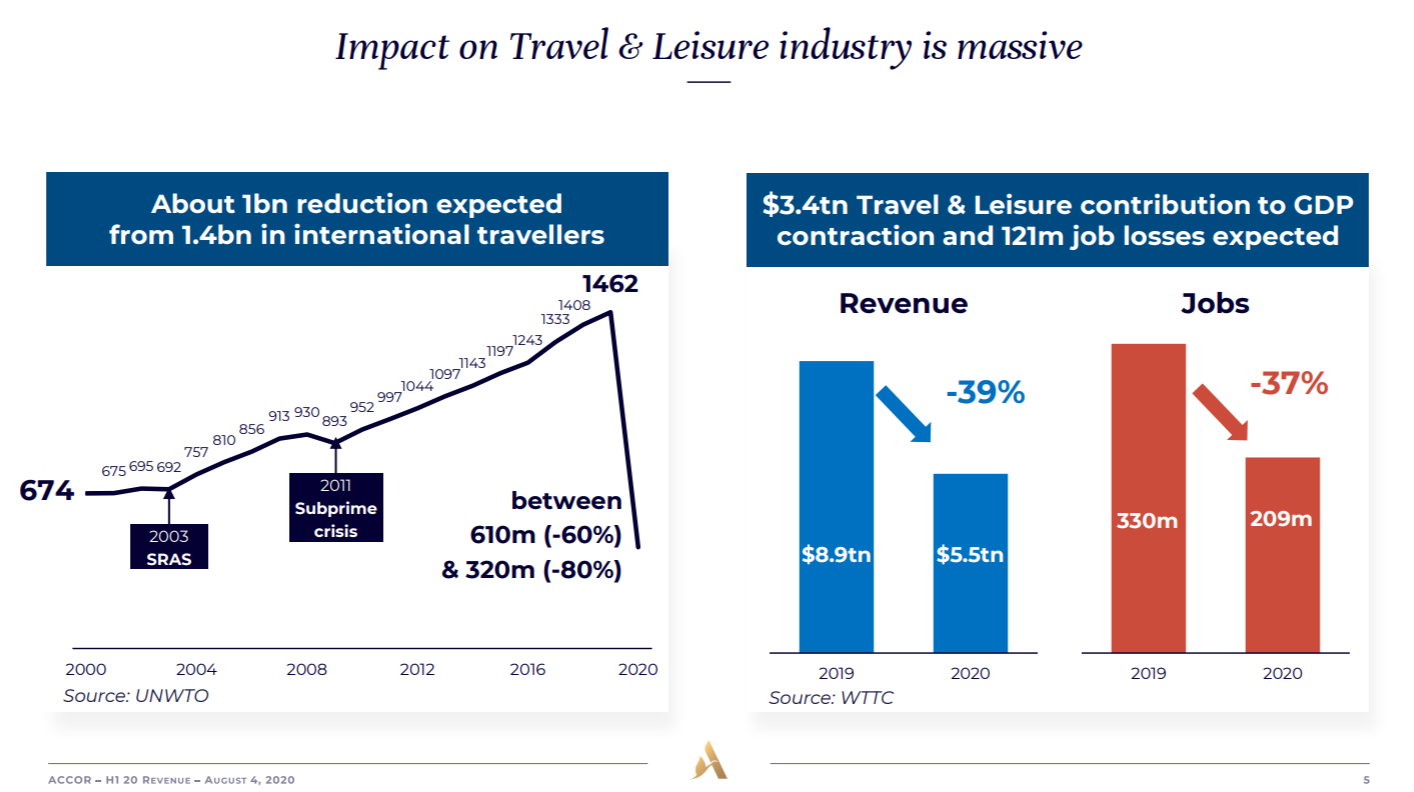

2020 Q2 Results in full damage control

As you can see below, Accor included broad macro economic data in the first page of its Q2 results which it usually doesn’t. Clearly preparing the reader for whats to come in the next slides, abysmal results. You will note that all the data is external to Accor and not internal company data.

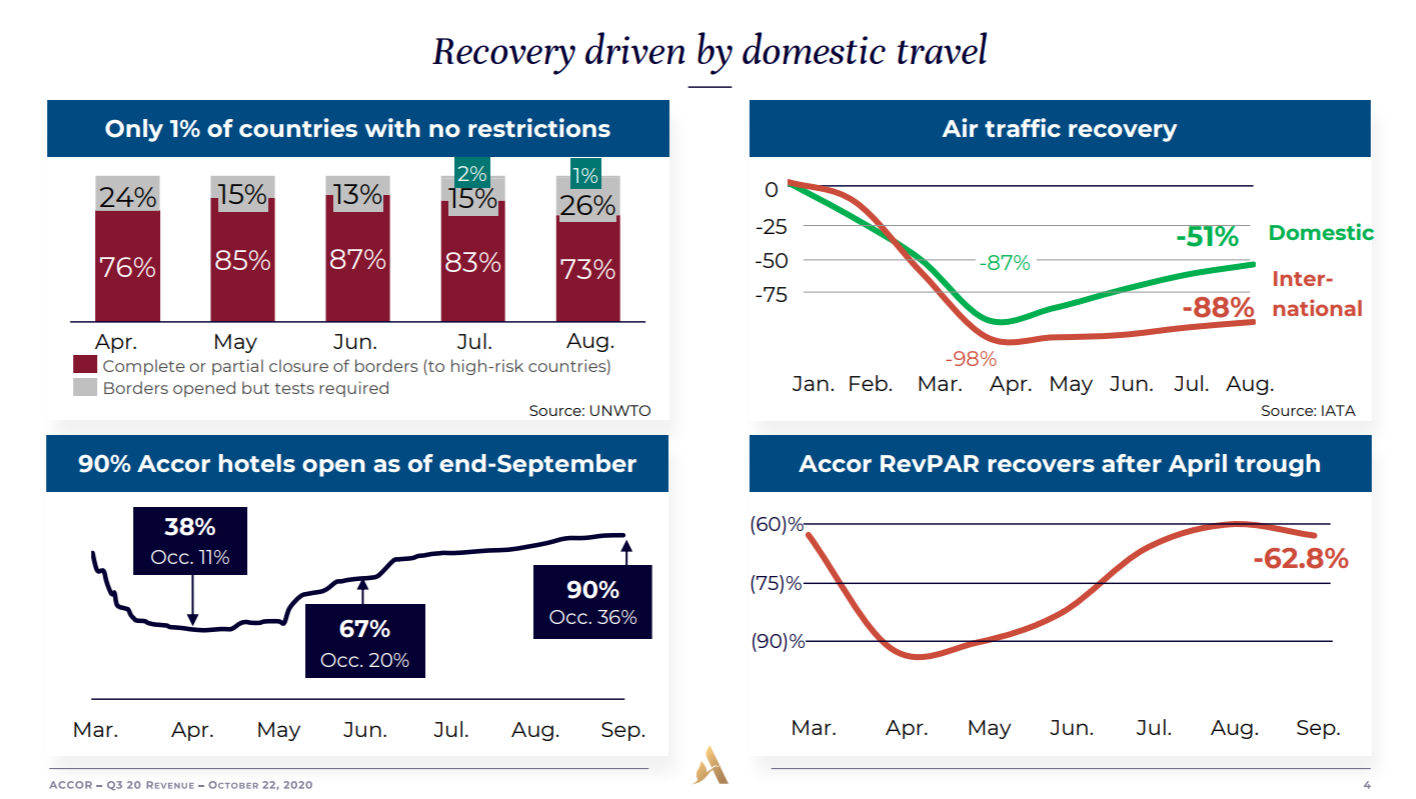

2020 Q3 Less drama in the results

Thankfully the drama has been dialed down a notch in the subsequent report, going back to more traditional formatting of the results, which we signal as a positive sign that management regained confidence in their ability to tamper the crisis with shareholders. Note that internal company data is reintroduced and make up the majority of the graphs.

The strategy

The company fully or partially owns over 20 brands that range from economy-level, such as ibis and the recently launched JO&JOE, to luxury, including Sofitel and Fairmont. The company also operates a number of adjacent businesses, including private rentals, concierge, dining & events services, and B2B digital booking platforms that it sells to other hotel businesses.

The Airbnb problem & response

3 pillars for reinvention

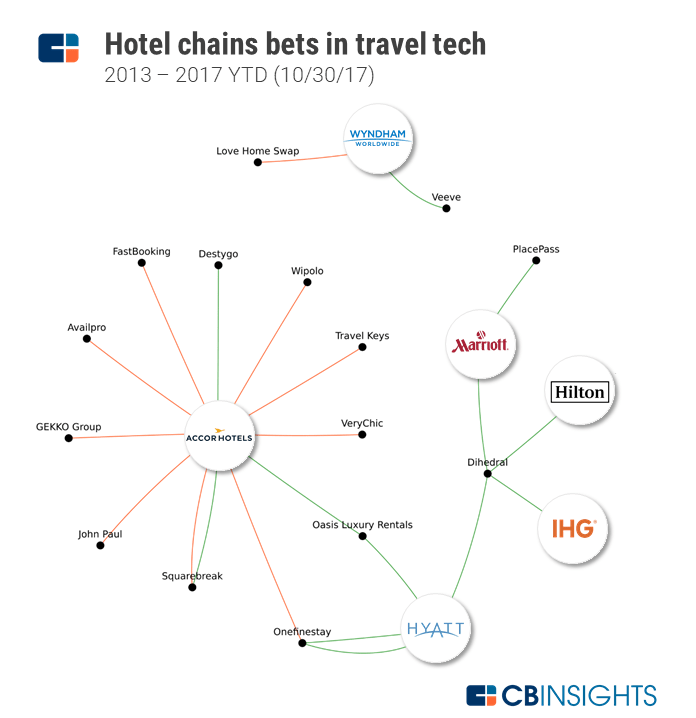

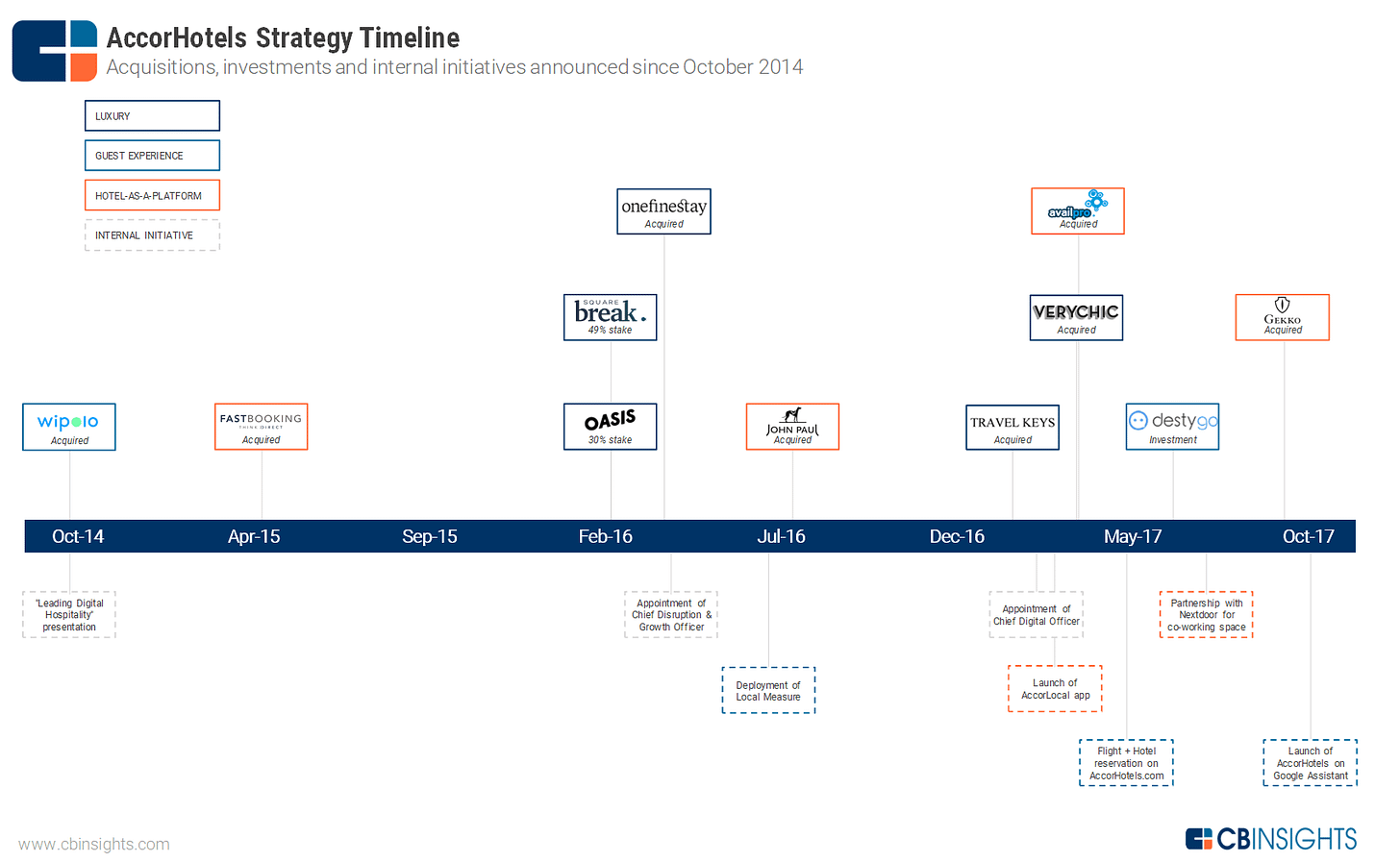

Since announcing its digital transformation plan in 2014, AccorHotels has not only acquired or invested in travel tech startups, it has also launched several initiatives that hint where the French hotel chain is heading.

Based on AccorHotels’ own comments and private market activity, we identified 3 strategic pillars on which it is building its future:

Creating new digital channels and improving existing ones

Growing the luxury business

Building a platform that offers services for guests and non-guests alike

Digital integrations

A simplified more agile business model

Visa Partnership

The new ALL Visa card is created by this new partnership, which collaborates Accor’s loyalty program and Visa’s global payment capabilities. The card will be used for all purchases wherein Visa is accepted. The ALL Visa card provides loyalty points and member perks in key markets across the world, which enables guests to accumulate points on making purchases and staying at an Accor property.The new launch shall provide unparalleled advantages to members of Accor. It is set to boost the success of the ALL loyalty program, increase its member base, enhance further engagement and cater to all the members via providing incentives.

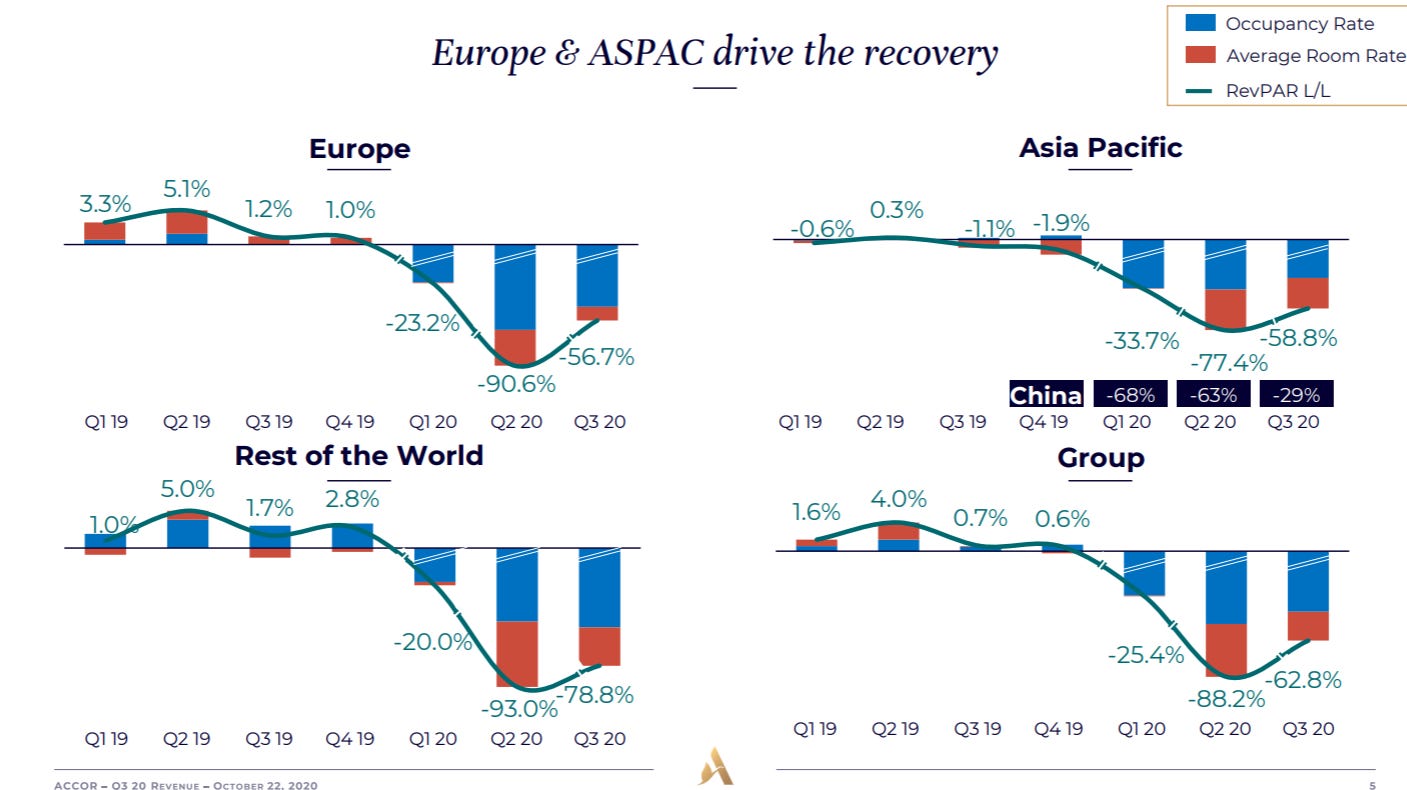

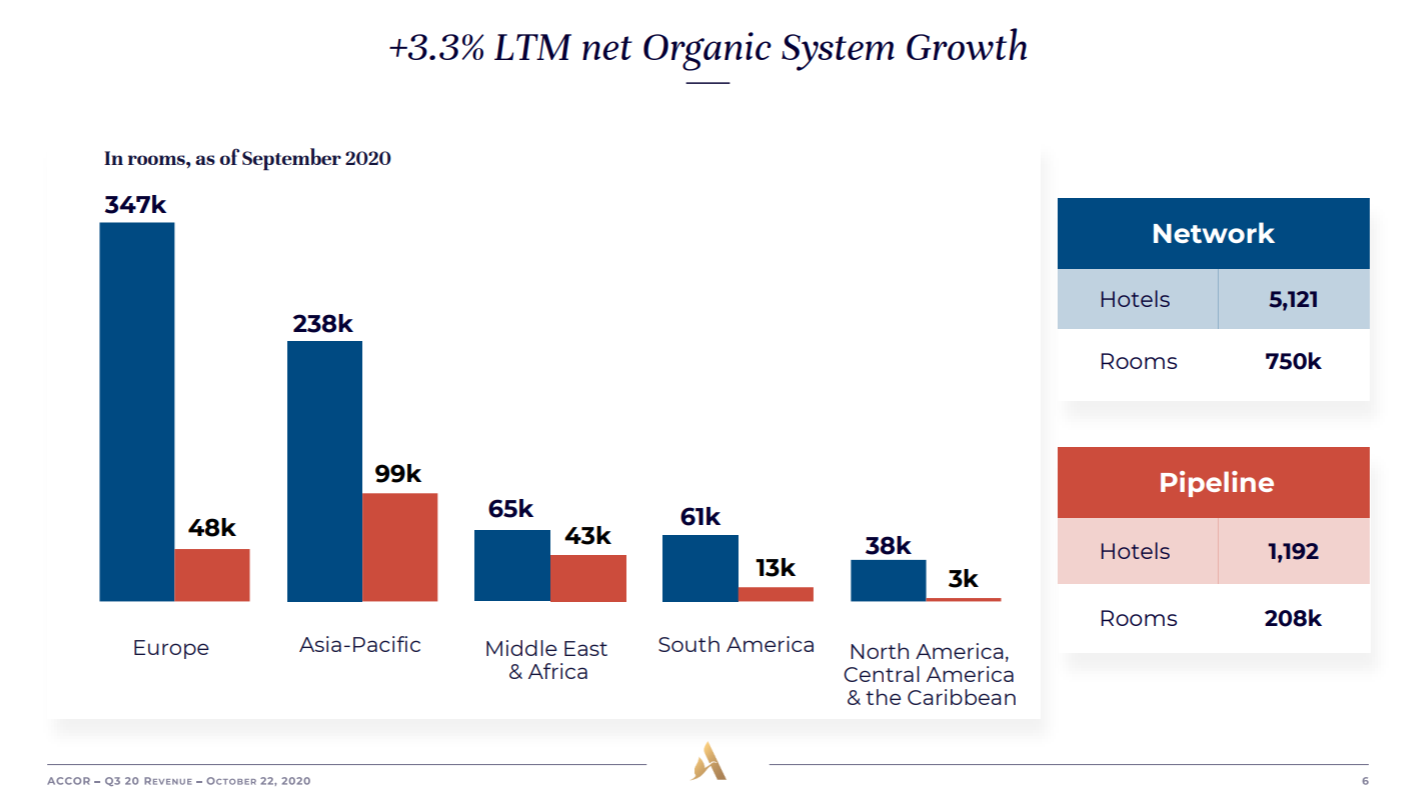

Geographical focus

While the company has a negligible footprint in the US, it is strong in Europe and is growing fast in Asia and the Middle East, the fastest growing markets in the travel industry. These are also the markets in which Accor is growing its hotel and room-count the fastest. The strong European presence is founded in the company’s history as 21% of the hotels are still in France, but with 8% of hotels in each China and Australia as the second-largest countries, it shows that Accor has come a long way to diversify its business.

Luxury acquisitions

Since AccorHotels announced its ambition to add 400 high-end hotels to its portfolio back in 2013, it has spent $2.7B to purchase the Fairmont, Raffles, and Swissotel luxury hotel brands; partnered with successful Asian hotel brand Banyan Tree; and announced several appointments to beef up its luxury development team.

This is where the stickiness is the greatest with the client because they are more loyal to a very luxury brand.” — Sébastien Bazin, CEO of AccorHotels, May 2017.

Accor launched an Airbnb alternative booking site for renting high-end luxury villas:

Accor vient de lancer un nouveau site web regroupant 50 000 appartements, villas et chalets de l'ensemble du groupe.

Le nouveau site web à l'adresse apartmentsandvillas.accor.com répertorie les propriétés des marques Adagio, Mantra et Hyde Living pour séjours prolongés, ainsi que des résidences privées de marque telles que Raffles Residences, Banyan Tree Residences, Delano Residences, Fairmont Residences et SLS Residences.

Le site comprend également des locations privées d'Onefinestay, le fournisseur de résidences services de luxe basé à Londres, acquis par Accor pour 117 millions de livres sterling en 2016.

What’s under the rug?

I see what you did there

Accor’s net debt as of end-June 2020 came to 1.092 billion euro ($1.285 billion), which was lower that than the 1.333 billion euro ($1.568 billion) it reported on 31 December, 2019.

This improved figure was due to the disposal of Orbis for 1.06 billion euro ($1.246 billion) in March 2020, and the classification of Accor’s headquarters at the Sequana Tower, located in Issy-les-Moulineaux, Paris, as asset and liabilities held for sale. “It’s going to be a reduction in net debt of a couple hundred million,” said Jean-Jacques Morin, deputy CEO.

The pessimists outlook (Fitch ratings)

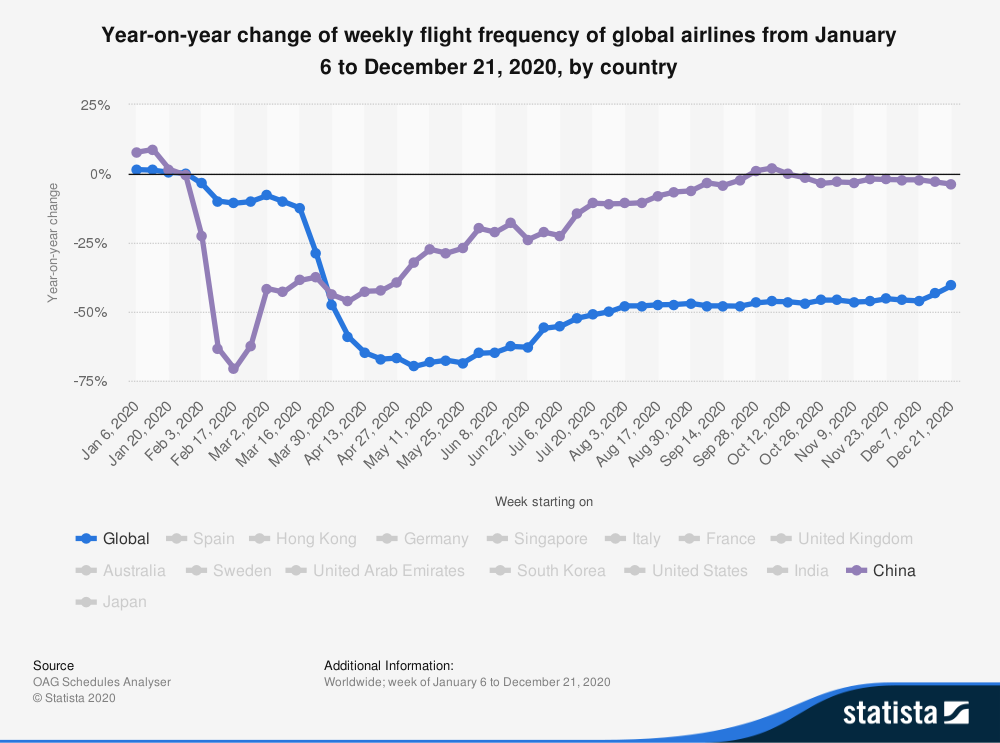

Strong domestic tourism has been essential for the temporary 3Q20 upturn, with budget regional hotels standing out as preferred options along with private rental and outdoor accommodation. However, 4Q is traditionally highly dependent on corporate events, conferences and Christmas attractions, which have not resumed and are unlikely to in the short term. Revenue per available room in 2020 and 2021 could end up 60%-65% and 35% respectively below past years' levels, reflecting the sector's high exposure to pandemic-related disruption.

Harmonized easing of movements, air connectivity and restoring of business activity will be key to normalizing the sector. These factors are directly linked to the availability of a vaccine or treatment, but safety protocols by hoteliers will remain a key element for travellers.

Ten downgrades and generalized Negative Outlooks across the rated European lodging portfolio reflect the significant disruption and weak 1H20 performance. The most affected companies in the next six months will be those relying on corporate activities and group travel. All hotels' cash flows have been severely affected despite government support via demand incentives, extended furlough programmes and ample liquidity sources. Maintaining adequate liquidity will remain a key ratings performance indicator for the sector.

Source: Fitch ratings

Fitch Downgrades Accor to 'BB+'

The downgrade reflects the longer-than-expected impact of the global pandemic on Accor's credit profile. This is exacerbated by the resurgence of second waves of infections, especially in Europe, and higher-than-anticipated RevPAR (revenue per available room) sensitivity, which is accentuating operating losses. New travelling restrictions are disrupting operations and, despite several cash-preservation measures and Accor's predominantly economy positioning (mainly through Ibis), increased cash burn will keep leverage metrics above 5.0x until 2022.

Progressive RevPAR recovery from 2H21, sustained cost savings in driving profitability recovery, and a disciplined financial policy should normalise cash flow and leverage to levels compatible with an investment-grade rating. Currently we do not expect such a profile would be achieved before 2023.

The Stable Outlook recognises Accor's leading market position, worldwide diversification and strong financial flexibility with solid liquidity headroom which should enable Accor to navigate the expected, albeit rather elongated, recovery phase.

Source: Fitch ratings

Debt restructuring for Accor Invest

Real estate group AccorInvest is in talks with its banks over a possible restructuring of more than 4 billion euros ($4.7 billion) of debts, financial daily Les Echos reported on its website.

AccorInvest owns and operates hotels managed by the Accor group and is present in 31 countries with 904 hotels, for brands including Ibis, Novotel and Mercure. In 2018, Accor opened AccorInvest's capital to sovereign wealth funds and institutional investors and kept a 30% minority stake.

As hotels worlwide run at reduced capacity because of coronavirus-related travel limits, AccorInvest has proposed a financial restructuring to its banks and requested a 450 million euro state-guaranteed loan.

AccorInvest has started talks with its 19 French banks and a mandate has been given to two court-appointed administrators.

The paper said that the banks are reluctant to agree to the company's request because it still has a comfortable cash position and because they want its deep-pocketed investors to take part in the restructuring effort.

AccorInvest's shareholders include the sovereign wealth funds of Saudi Arabia and Singapore, real estate fund Colony Capital, Credit Agricole Assurances and Amundi.

Source: Yahoo Finance

Future outlook

Cash

Going forward, its liquidity position exceeds 4 billion euro ($4.7 billion), which means it could survive another 40 months under current market conditions. Accor also expects 5 to 10 percent of its room counts in the future to be used as workplaces, due to the growing trend of working from home.

Occupancy rate recovery

As of August 3, 81 percent of the group’s hotels were open, equivalent to 4,000 units.

In terms of occupancy rates, it said China was at 60 percent; France 56 percent; Germany 39 percent; UK 35 percent; and North and Central America 35 percent.

However, the Middle East and Africa remained penalized by the lack of religious pilgrims to the holy city in Saudi, which is a lucrative part of its business in the region.

Overall, its revenue per available room, or RevPAR, dropped 59.3 percent in the first-half 2020.

Revenue from its hotel services division fell a similar amount, down 52.8 percent to 650 million euro ($764 million).

CEO’s outlook for the future

Sebastien Bazin, Accor CEO

His comments:

“Our customers will be more green, more sensitive to community involvment.”

“The segment that thrives during this crisis is the economy segment, people switch from Novotel to Ibis etc.”

“China is where it is happening right now”

“The 2 most important keyword searched according to Google right now are Travel & Leisure. People need oxygen, we will be surprised on the bounce back”

“We are ready for 2 years of crisis, but it won’t happen”

Sanitation Moat

We believe that Accor will be better prepared to implement virus containment best within the customer experience compared to Mom and Pop competitor hotels.

We also believe that customer will favor big groups such as Accor in determining their booking choice simply on the perceived sanitary quality (room cleanliness, restaurant & staff interaction).

Global travelers (79%) will take more precautions due to Coronavirus and will look to the travel industry to help them gear up for this new normal. Governments, travel associations and providers will have to work cohesively to set consistent standards to help keep travelers safe, and with expectations heightened, some destinations and businesses will need to work harder to regain travelers’ trust. 59% of travelers will avoid certain destinations (rising to 67% of Baby Boomers), and 70% expect tourist attractions to adapt to allow for social distancing. At the same time, 70% will only book a particular accommodation if it’s clear what health and hygiene policies it has in place, with three quarters (75%) favoring accommodations that have antibacterial and sanitizing products.

Source: Booking.com

Pivoting to a “WeWork” offering

Novotel Le Havre

The Hotel Office is the home office only better – no distractions, clean ALLSAFE approved surroundings, room service and hotel amenities plus complete flexibility to book whenever there’s the need, even at an hour’s notice. With a range of Accor hotels and brands offering Hotel Offices there are options from as little as €35 per day.

A home office away from your home office. Only better. Because why shouldn’t you work in comfort?

Think welcoming smiles, great coffee, plush sofas, intelligent lighting, fantastic design. Think bars, restaurants, wellbeing and board rooms right there when you need them.

It’s hotel office, and it’s redefining convenience, blending life and work.

Source Accor Hotel Office

Over a third (37%) of travelers have already considered booking somewhere to stay in order to work from a different destination, while 40% would be willing to quarantine if they could work remotely. Travel platforms and places to stay will prioritise showcasing home office facilities and Wi-Fi speed in an attempt to attract this new wave of digital nomads. Likewise, the world of corporate travel will see increasing demand for privacy, cleanliness and longer stays among those traveling for business, requiring alternative accommodations to seriously up their ‘work-friendly’ game. While companies will undoubtedly reassess their approach to business travel in the future, workers will continue to maximise the trips they do take, with over half of travelers (52%) saying they would take the opportunity to extend any business trips to also enjoy leisure time at the destination.

Source: booking.com

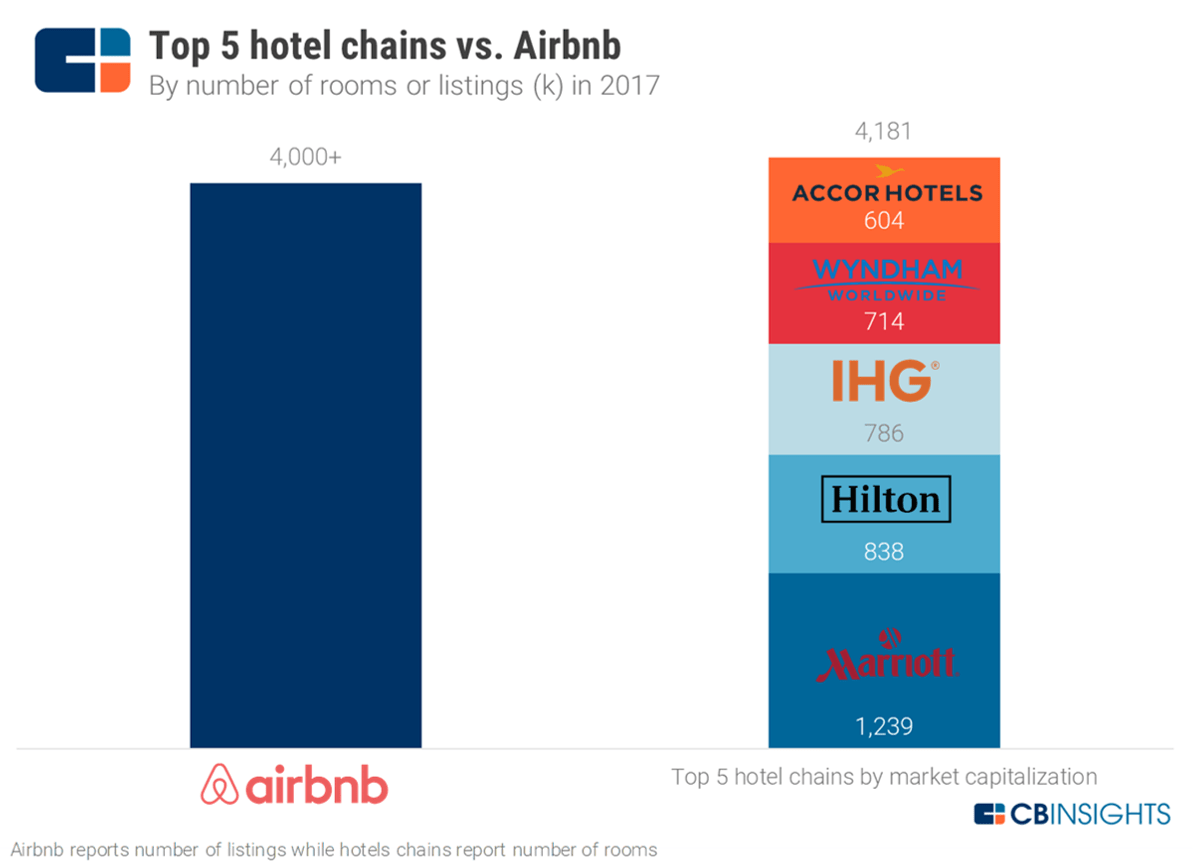

Potential merger with IHG? or just fluff?

Le Figaro newspaper reported it had examined a potential merger with British rival InterContinental Hotels (IHG) that would create the world's biggest hotel group.

Le Figaro said no formal approach had been made by Accor to IHG, which owns Holiday Inn and Crowne Plaza. Based on current prices, a combined firm could have a market value of about $17 billion.

Without citing sources, it added Accor's management board was in favour of a deal, but Accor chairman and CEO Sebastien Bazin, who had set up an internal taskforce on the matter, was more cautious about moving ahead.

A marriage between the two firms would propel them far ahead of U.S. rival Marriott by number of hotel rooms, with over 1.6 million between the two.

It could also make geographical sense, with Accor and its brands more skewed towards Europe, while IHG has larger operations in the United States and is also growing fast in Greater China.

Source: Yahoo finance

Return of the travel consumers

Amidst new waves of travel hiatuses, restrictions and continued uncertainty, our innate human desire to travel has not been dampened. During recent lockdowns two-thirds (65%) of travelers reported being excited about traveling again, while 61% indicated they are more appreciative of travel and will likewise not take it for granted in the future. Travelers also report that they plan to take a similar number of trips both domestically and internationally in the 12 months after travel restrictions are lifted in their country, as they did in the year pre-pandemic (March 2019 - March 2020).

Our time at home has made us crave the world outside more than ever with over half (53%) of respondents asserting a heightened desire to see even more of the world, and 42% wanting to travel more in the future to make up for time lost in 2020 (rising to 51% for Gen Z and 49% of Millennials). What’s more, over a third (38%) intend to plan a trip to make up for a celebration missed due to Coronavirus (such as a milestone birthday or wedding), while two fifths (40%) intend to rebook a trip they had to cancel. With this, we can expect travel companies to get creative in 2021 with new itineraries and recommendations designed to capture the imaginations of travelers who missed out on trips in 2020 and who will be looking for somewhere stunning to explore to make their next trip more meaningful.

Source: booking.com

Our subjective opinion

It is our belief that travel will slowly recover and Accor’s underlying operations with it.

It is clear from the stock performance that the share price is still discounted, and that the worst has passed.

Therefore, we are contrarian long the share and have a price target of €39, with a 6 to 18 months timeframe.

It is also possible that the share price retracts on the short term for the next 1 to 9 months.

Potential Hedges:

CAC40

EURO stoxx 600

iShares STOXX Europe 600 Travel & Leisure UCITS ETF (DE)

Available instruments:

Traditional shares

Options

CFD

Warrants

Turbos